Introduction

Challenges abound in the business world due to global economic shifts, technological advancements, regulatory changes, or even competitive pressures. According to recent research by PwC, 57% risk professionals agreed that they see better quality decisions leading to better business outcomes based advanced on risk insights from tech applications.

This underscores the critical need for strategic risk management, a discipline aimed at proactively identifying, assessing, and addressing risks that could derail strategic goals.

This article provides a deep dive into strategic risk management, why it is important for organizations, how to assess strategic risks, best practices for implementing strategic risk management, and more.

Key Takeaways

- Strategic risk management enables organizations to capitalize on opportunities that arise in dynamic environments. By understanding potential risks and aligning risk responses with strategic objectives, organizations can position themselves to take calculated risks that lead to growth and competitive advantage.

- Ultimately, strategic risk management is all about fostering sustainable growth. By providing a comprehensive view of potential threats and opportunities, strategic risk management empowers organizations to make informed decisions aligned with long-term goals.

- Adopting strategic risk management practices fosters organizational agility, enabling swift adaptation to changing market conditions and the ability to overcome unexpected disruptions.

- Robust risk management practices enhance investor confidence by demonstrating a commitment to sustainability and effective long-term risk mitigation.

What is Strategic Risk?

Strategic risk refers to potential threats that can impact an organization’s ability to achieve its long-term goals and objectives. Unlike operational or financial risks, which focus on day-to-day processes and monetary concerns, strategic risks stem from high-level business decisions, market dynamics, and external factors that influence the organization's competitive position.

Key Causes of Strategic Risk

- Market Changes – Shifts in customer preferences, emerging competitors, or disruptive technologies can make an existing business model obsolete.

- Regulatory and Compliance Risks – Changes in government policies, industry regulations, or legal requirements can affect business operations and profitability.

- Reputation and Brand Risks – Negative publicity, ethical concerns, or customer dissatisfaction can erode brand trust and market value.

- Innovation and Technology Risks – Failure to adapt to technological advancements or invest in innovation can put a company at a disadvantage.

- Mergers, Acquisitions, and Expansion Risks – Poorly executed mergers, acquisitions, or market expansions can lead to financial losses and integration challenges.

Managing Strategic Risk

To mitigate strategic risk, organizations must adopt a proactive approach, which includes:

- Regular Strategic Reviews – Continuously assessing business strategies in response to market and industry changes.

- Scenario Planning – Forecasting different risk scenarios and preparing contingency plans.

- Risk-Based Decision Making – Embedding risk assessment into the strategic planning process.

- Agility and Adaptability – Maintaining flexibility in business operations to respond quickly to emerging threats and opportunities.

Strategic risk is an inherent part of doing business, but organizations that effectively anticipate and manage it can enhance resilience, maintain a competitive edge, and drive sustainable growth.

What is Strategic Risk Management?

Strategic risk management is the structured process of identifying, assessing, and mitigating risks that could impact a company’s long-term objectives and overall business strategy. These risks can stem from internal or external factors such as technological advancements, regulatory shifts, market disruptions, or changes in consumer behavior.

Strategic risk management is a systematic process of identifying risks, assessing their impact, and taking action to mitigate them to capitalize on the opportunities it brings. These risks could be influenced by factors from within or outside, such as manufacturing delays, regulatory changes, advancement in technology or even changing consumer behaviour.

It goes beyond dealing with the here and now, focusing instead on long-term objectives and identifying external and internal threats that could derail these goals.

While operational risk management addresses the day-to-day hurdles a company might face, strategic risk management is all about looking at the bigger picture. It’s about understanding and mitigating risks that could fundamentally alter a company’s trajectory or even threaten its existence.

Strategic risk management goes beyond addressing immediate challenges; it focuses on long-term goals and potential threats that could disrupt an organization’s success. Unlike operational risk management, which deals with daily risks, strategic risk management evaluates broader risks that could reshape a company’s future or threaten its sustainability.

By proactively identifying risks—whether from regulatory changes, supply chain disruptions, or evolving market trends—businesses can develop strategies to mitigate threats and seize emerging opportunities. This approach ensures resilience, adaptability, and alignment with long-term objectives.

Strategic Risk Management Examples

By examining real-world examples, we gain insights into the pivotal role of strategic risk management in securing a company's future. Let’s have a look at one below:

The Kodak Moment: The Peril of Ignoring Technological Advancement

One of the most illustrative examples of the failure to manage strategic risk comes from the downfall of Kodak, once a titan in the photography industry. Kodak's decline was not due to operational inefficiencies but stemmed from a monumental strategic oversight: the underestimation of digital photography's potential to disrupt the film market.

Kodak, despite inventing the first digital camera in 1975, chose to sideline the technology, fearing it would cannibalize its film business. This decision illustrates a critical strategic risk—failing to adapt to technological advancements.

The consequences of this miscalculation were profound. By the time Kodak acknowledged the shift in consumer preferences towards digital photography, competitors had already secured a stronghold in the market.

Kodak's hesitation to pivot and innovate led to a loss in market share, diminishing brand value, and, eventually, bankruptcy in 2012.

It serves as a powerful testament to the importance of acknowledging and adapting to technological trends, underlining how strategic risk management is not just about sidestepping threats but also about ensuring organizational agility and resilience.

Strategic Risk Management Framework

A strategic risk management framework is a structured approach adopted by organizations to identify, assess, and manage risks that could potentially impact their strategic objectives and long-term success.

It encompasses processes, methodologies, and tools aimed at aligning risk management activities with the organization's strategic goals, enabling informed decision-making and enhancing resilience in the face of uncertainties.

Some of the most well-known strategic risk management frameworks are the COSO ERM framework, NIST RMF, and ISO 31000.

How to Identify Strategic Risks

Identifying strategic risks involves analyzing potential threats that could disrupt an organization’s long-term goals and overall business strategy. These risks can arise from internal operations, industry trends, or external economic and regulatory environments. The key steps to identifying strategic risks include:

1. Environmental Scanning

- Assess external factors such as market trends, competitor actions, economic changes, and technological advancements.

- Monitor political and regulatory developments that could impact business operations.

- Use industry reports, financial forecasts, and competitive intelligence tools to stay informed.

2. Internal Analysis

- Review internal processes, financial stability, and resource allocation to identify vulnerabilities.

- Evaluate operational efficiency and scalability to determine areas of potential risk.

- Conduct employee and stakeholder feedback sessions to uncover overlooked challenges.

3. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

- Identify organizational strengths and weaknesses to determine how well the company can withstand risks.

- Analyze external opportunities and threats that may affect long-term business strategy.

- Use insights to align strategic objectives with potential risk mitigation measures.

4. Scenario Planning and Stress Testing

- Develop multiple risk scenarios, including best-case, worst-case, and probable-case situations.

- Simulate the impact of major disruptions, such as supply chain failures, economic downturns, or regulatory shifts.

- Assess how the company would respond and adjust strategies accordingly.

5. Stakeholder Consultation

- Engage with key stakeholders, including executives, investors, employees, and customers, to gain diverse perspectives on potential risks.

- Consider industry partnerships and expert opinions to assess risks comprehensively.

- Ensure cross-functional collaboration to capture risks across different business areas.

6. Use of Risk Management Tools and Data Analytics

- Implement AI-driven analytics, risk assessment software, and market intelligence tools to detect emerging risks.

- Leverage historical data to predict potential threats and analyze trends.

- Continuously monitor risk indicators and adjust strategies as needed.

Strategic Risk Factors and Their Types

Strategic risks arise from various internal and external factors that can impact an organization’s ability to achieve its long-term objectives. Understanding these risk factors is crucial for effective risk management and decision-making.

1. Competitive Risks

Changes in the competitive landscape, such as new market entrants, industry disruptions, or innovative technologies, can threaten a company’s position and profitability.

2. Market and Economic Risks

Fluctuations in the economy, shifts in consumer demand, inflation, or global economic downturns can affect revenue, pricing strategies, and overall business sustainability.

3. Regulatory and Compliance Risks

Changes in government policies, industry regulations, or legal frameworks can lead to operational challenges, financial penalties, or reputational damage if not managed properly.

4. Technological Risks

Failure to keep up with technological advancements or cybersecurity threats can result in inefficiencies, data breaches, and loss of competitive advantage.

5. Reputation and Brand Risks

Negative media coverage, customer dissatisfaction, or ethical controversies can harm an organization’s credibility, reducing consumer trust and investor confidence.

6. Operational and Supply Chain Risks

Disruptions in supply chains, manufacturing failures, or inefficiencies in business processes can directly impact a company’s ability to deliver products and services effectively.

7. Strategic Execution Risks

Poor decision-making, leadership challenges, or misalignment between strategy and execution can lead to business failure or missed opportunities for growth.

By identifying and addressing these strategic risk factors, organizations can build resilience and ensure sustainable success.

How to Identify Strategic Risks?

Identifying strategic risks requires a systematic approach to evaluating potential threats and their impact on long-term business objectives. Here are key steps to effectively identify strategic risks:

1. Conduct a Risk Assessment

Evaluate the internal and external environment to pinpoint potential threats. Use frameworks like SWOT (Strengths, Weaknesses, Opportunities, and Threats) or PESTEL (Political, Economic, Social, Technological, Environmental, and Legal) analysis to assess risk factors.

2. Analyze Market and Industry Trends

Monitor industry shifts, competitor movements, and economic changes that could impact business strategy. Staying informed helps in anticipating risks before they become critical issues.

3. Engage Stakeholders and Leadership Teams

Involve executives, department heads, and key stakeholders in discussions about emerging risks. Their insights can help uncover vulnerabilities that may not be immediately apparent.

4. Evaluate Past Performance and Failures

Review historical data, past strategic decisions, and their outcomes to identify patterns of risk exposure. Understanding previous challenges can help mitigate future risks.

5. Scenario Planning and Stress Testing

Develop “what-if” scenarios to assess how different risks could impact the business. Conduct stress tests to understand the organization’s ability to withstand potential disruptions.

6. Utilize Risk Management Tools and Technology

Leverage risk assessment software, data analytics, and AI-driven insights to detect patterns and predict potential strategic risks before they materialize.

7. Establish Continuous Monitoring and Reporting

Risk identification is an ongoing process. Regularly reviewing risk indicators, setting up early warning systems, and adapting strategies based on real-time insights help in proactive risk management.

By integrating these practices, businesses can identify strategic risks early, develop mitigation plans, and create a more resilient and adaptable organization.

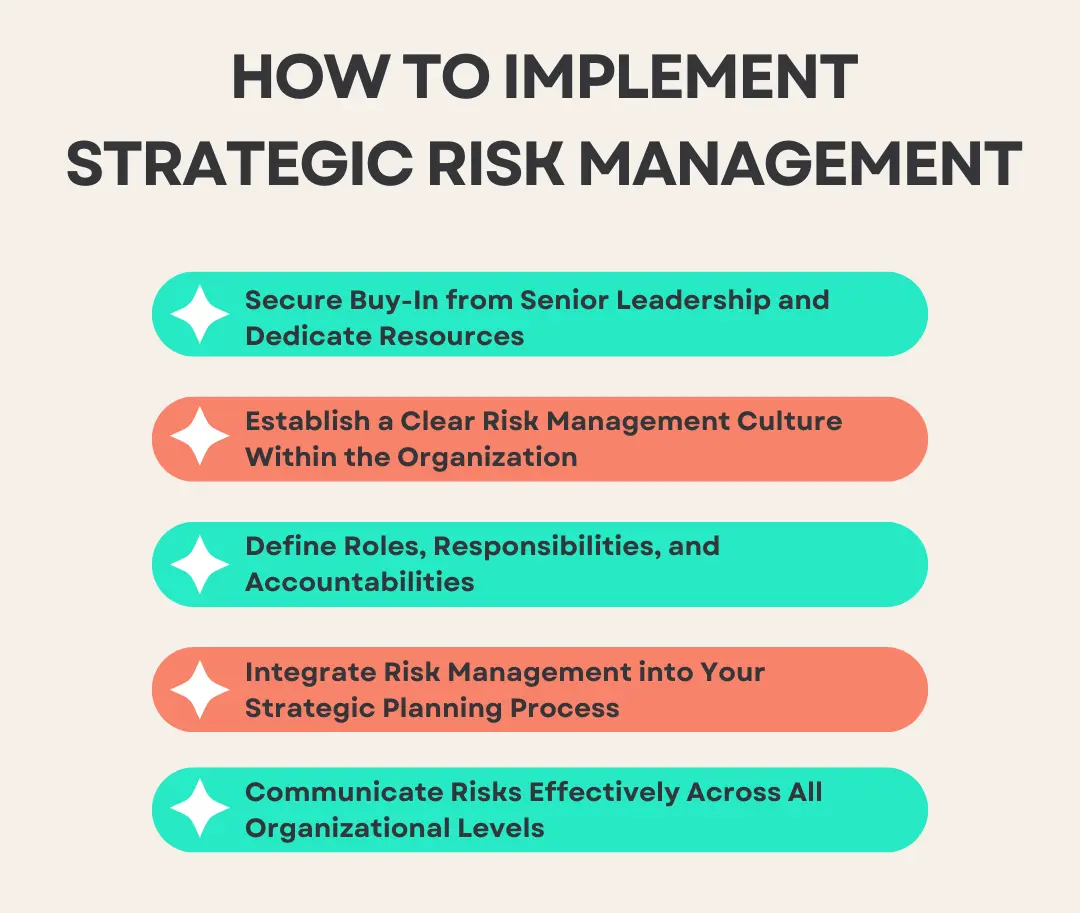

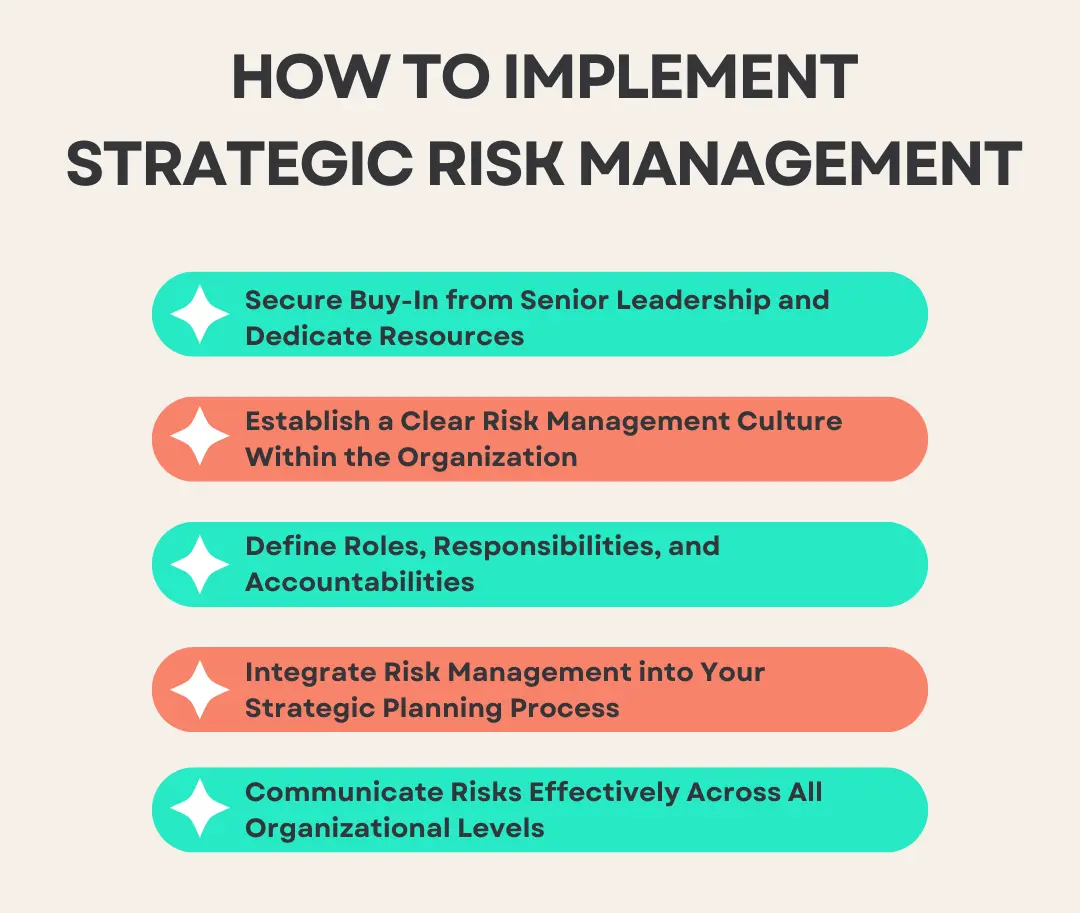

How To Implement Strategic Risk Management?

Here are actionable steps for organizations to implement strategic risk management:

Secure Buy-In from Senior Leadership and Dedicate Resources:

The first step towards implementing strategic risk management involves securing a commitment from the top. This commitment boils down to allocating the necessary resources—be it financial, human, or technological. Leadership engagement is critical to championing the initiative across the organization.

Establish a Clear Risk Management Culture Within the Organization:

Establishing and maintaining a culture that values proactive risk management can encourage openness, improve risk reporting, and ensure that all levels of the organization participate in identifying and mitigating risks. This culture is foundational for a strategic approach to risk management.

Define Roles, Responsibilities, and Accountabilities:

Organizations should define and document the roles, responsibilities, and accountabilities of employees involved in strategic risk management processes. This is important to not only streamline the process but also ensure that there are no overlaps or duplication of efforts.

Integrate Risk Management into Your Strategic Planning Process:

Risk management should not operate in silos but should be a part of the strategic planning process. This integration ensures that risks are considered in every strategic decision and that the organization's objectives are aligned with its risk appetite.

Communicate Risks Effectively Across All Organizational Levels:

Effective communication is vital for the success of strategic risk management. It involves communicating the identified risks, their potential impact, and the measures put in place to mitigate them. This transparency ensures that everyone in the organization is on the same page and can act in a coordinated manner when managing risks.

How To Measure Strategic Risk?

Strategic risks are inherently different from operational or financial risks due to their impact on an organization's long-term goals, competitive advantage, and overall business strategy. Unlike operational risks, which typically involve day-to-day processes or systems, and financial risks, which focus on monetary aspects like investments or liquidity, strategic risks encompass broader considerations.

These risks are intricately tied to an organization's strategic decisions, market positioning, and ability to adapt to changing environments. There are two widely used key metrics that help measure strategic risk – economic capital and risk-adjusted return on capital (RAROC):

- Economic Capital: It is the amount of capital that an organization needs in order to stay solvent given its risk profile. In other words, it is the amount of capital that can cover the potential losses resulting from risks.

- Risk-Adjusted Return on Capital (RAROC): Organizations use this metric to understand the returns on investments (ROI) in the context of the risks taken by it. It is calculated by dividing the estimated after-tax return on an initiative by its economic capital. An initiative is viable if RAROC exceeds the organization’s cost of capital.

Why is Strategic Risk Management Important?

Strategic risk management is a pivotal element in a world characterized by volatility, uncertainty, complexity, and ambiguity. Its importance can be seen across various facets of an organization. This approach fosters agility, allowing businesses to adapt to emerging risks and seize opportunities.

By anticipating and mitigating setbacks, organizations build resilience and ensure operational continuity. Robust risk management practices also enhance investor confidence, signaling sustainability and growth potential, which can attract stable and increased investment.

Here are some of the top reasons why strategic risk management is important for businesses:

- Better Risk Visibility and Foresight: An effective strategic risk management program empowers an organization to anticipate emerging risks as well as opportunities. The improved visibility enables them to stay ahead of the curve and take proactive measures to turn them into a strategic advantage.

- Enhanced Agility: This process helps organizations be more agile, enabling them to adjust their strategies in response to emerging risks and opportunities. This is crucial for staying competitive and can make the difference between thriving and merely surviving.

- Increased Resilience: Unexpected challenges and disruptions are part and parcel of the business world. Organizations equipped with a strategic approach to risk management can anticipate potential setbacks and develop strategies to mitigate them. This preparedness helps them emerge stronger, ensuring the continuity of operations even in turbulent times.

- Improved Decision-making: The comprehensive understanding of organizational risks and opportunities allows for more informed decision-making, enabling leaders to weigh the pros and cons of various paths forward. It shifts the narrative from reactive to proactive, positioning organizations to survive and thrive in the face of uncertainties.

- Boosted Investor Confidence: Investors are increasingly looking at the robustness of an organization’s risk management practices as a marker of its sustainability and growth potential. Demonstrating a commitment to comprehensive risk management can significantly enhance investor trust and confidence, potentially leading to more stable and increased investment.

Strategic Risk Management Process

Managing strategic risks requires a structured approach to identifying, assessing, and mitigating threats while ensuring business continuity. The key steps in the strategic risk management process include:

1. Risk Identification

- Identify strategic risks through environmental scanning, internal assessments, and stakeholder consultations.

- Categorize risks based on their origin — financial, operational, regulatory, technological, or market-driven.

2. Risk Assessment and Prioritization

- Evaluate risks based on their likelihood and potential impact on the organization’s strategic goals.

- Use qualitative and quantitative risk assessment techniques, such as risk matrices and financial modeling.

- Prioritize risks based on their severity and the organization’s risk tolerance.

3. Risk Mitigation and Response Planning

- Develop mitigation strategies, including contingency planning and proactive risk controls.

- Implement preventive measures such as process improvements, diversification strategies, and regulatory compliance initiatives.

- Assign responsibilities for managing each identified risk.

4. Risk Monitoring and Reporting

- Continuously track risk indicators, market developments, and internal performance metrics.

- Establish a risk governance framework with regular reporting to senior leadership and stakeholders.

- Conduct periodic reviews to reassess risks and update mitigation strategies.

5. Continuous Improvement and Adaptation

- Regularly refine risk management strategies based on new insights and changing business conditions.

- Foster a risk-aware culture within the organization through training and communication.

- Leverage technology and data analytics to enhance risk detection and response.

How Can MetricStream Help You?

MetricStream Enterprise Risk Management software is a powerful solution that can help organizations streamline their strategic risk management processes. By offering an integrated risk management solution that covers risk identification, assessment, mitigation, and reporting, MetricStream simplifies these complex tasks and also ensures they are interlinked and feed into one another.

This interconnectedness is vital for organizations aiming to make strategic decisions that are informed, agile, and resilient in the face of uncertainties.

To learn more about MetricStream Enterprise Risk Management(ERM) , request a personalized demo today.

Frequently Asked Questions (FAQ)

What are the steps of the strategic risk management process?

The steps of the strategic risk management process typically include the identification, assessment, prioritization, mitigation, and monitoring of strategic risks.

What are the key principles of strategic risk management?

The key principles of strategic risk management include aligning risk management with organizational objectives, fostering a risk-aware culture, integrating risk management into decision-making processes, and continuously monitoring and adapting to changes.

What is the difference between strategic risk management and enterprise risk management?

Strategic risk management focuses specifically on risks that impact an organization's strategic objectives and competitive position, whereas enterprise risk management (ERM) covers a broader spectrum of risks across all areas of an organization's operations.operations.íñ

What are examples of strategic risk?

Examples of strategic risk include market competition, regulatory changes, technological disruptions, economic downturns, reputational damage, and failed mergers or expansions.

What is the scope of strategic risk management?

The scope of strategic risk management includes identifying, assessing, and mitigating risks that impact business strategy, such as market dynamics, operational challenges, compliance issues, and long-term growth objectives.

What are the 5 risk management strategies?

The five key risk management strategies are risk avoidance, risk reduction, risk sharing (or transfer), risk retention, and risk acceptance.

What is an example of a strategic risk?

An example of a strategic risk is a company failing to adapt to new technology, leading to a competitive disadvantage and loss of market share.

What are the principles of strategic risk management?

The core principles of strategic risk management include proactive risk identification, alignment with business strategy, continuous monitoring, adaptability, and informed decision-making based on data and insights.

Challenges abound in the business world due to global economic shifts, technological advancements, regulatory changes, or even competitive pressures. According to recent research by PwC, 57% risk professionals agreed that they see better quality decisions leading to better business outcomes based advanced on risk insights from tech applications.

This underscores the critical need for strategic risk management, a discipline aimed at proactively identifying, assessing, and addressing risks that could derail strategic goals.

This article provides a deep dive into strategic risk management, why it is important for organizations, how to assess strategic risks, best practices for implementing strategic risk management, and more.

- Strategic risk management enables organizations to capitalize on opportunities that arise in dynamic environments. By understanding potential risks and aligning risk responses with strategic objectives, organizations can position themselves to take calculated risks that lead to growth and competitive advantage.

- Ultimately, strategic risk management is all about fostering sustainable growth. By providing a comprehensive view of potential threats and opportunities, strategic risk management empowers organizations to make informed decisions aligned with long-term goals.

- Adopting strategic risk management practices fosters organizational agility, enabling swift adaptation to changing market conditions and the ability to overcome unexpected disruptions.

- Robust risk management practices enhance investor confidence by demonstrating a commitment to sustainability and effective long-term risk mitigation.

Strategic risk refers to potential threats that can impact an organization’s ability to achieve its long-term goals and objectives. Unlike operational or financial risks, which focus on day-to-day processes and monetary concerns, strategic risks stem from high-level business decisions, market dynamics, and external factors that influence the organization's competitive position.

Key Causes of Strategic Risk

- Market Changes – Shifts in customer preferences, emerging competitors, or disruptive technologies can make an existing business model obsolete.

- Regulatory and Compliance Risks – Changes in government policies, industry regulations, or legal requirements can affect business operations and profitability.

- Reputation and Brand Risks – Negative publicity, ethical concerns, or customer dissatisfaction can erode brand trust and market value.

- Innovation and Technology Risks – Failure to adapt to technological advancements or invest in innovation can put a company at a disadvantage.

- Mergers, Acquisitions, and Expansion Risks – Poorly executed mergers, acquisitions, or market expansions can lead to financial losses and integration challenges.

Managing Strategic Risk

To mitigate strategic risk, organizations must adopt a proactive approach, which includes:

- Regular Strategic Reviews – Continuously assessing business strategies in response to market and industry changes.

- Scenario Planning – Forecasting different risk scenarios and preparing contingency plans.

- Risk-Based Decision Making – Embedding risk assessment into the strategic planning process.

- Agility and Adaptability – Maintaining flexibility in business operations to respond quickly to emerging threats and opportunities.

Strategic risk is an inherent part of doing business, but organizations that effectively anticipate and manage it can enhance resilience, maintain a competitive edge, and drive sustainable growth.

Strategic risk management is the structured process of identifying, assessing, and mitigating risks that could impact a company’s long-term objectives and overall business strategy. These risks can stem from internal or external factors such as technological advancements, regulatory shifts, market disruptions, or changes in consumer behavior.

Strategic risk management is a systematic process of identifying risks, assessing their impact, and taking action to mitigate them to capitalize on the opportunities it brings. These risks could be influenced by factors from within or outside, such as manufacturing delays, regulatory changes, advancement in technology or even changing consumer behaviour.

It goes beyond dealing with the here and now, focusing instead on long-term objectives and identifying external and internal threats that could derail these goals.

While operational risk management addresses the day-to-day hurdles a company might face, strategic risk management is all about looking at the bigger picture. It’s about understanding and mitigating risks that could fundamentally alter a company’s trajectory or even threaten its existence.

Strategic risk management goes beyond addressing immediate challenges; it focuses on long-term goals and potential threats that could disrupt an organization’s success. Unlike operational risk management, which deals with daily risks, strategic risk management evaluates broader risks that could reshape a company’s future or threaten its sustainability.

By proactively identifying risks—whether from regulatory changes, supply chain disruptions, or evolving market trends—businesses can develop strategies to mitigate threats and seize emerging opportunities. This approach ensures resilience, adaptability, and alignment with long-term objectives.

By examining real-world examples, we gain insights into the pivotal role of strategic risk management in securing a company's future. Let’s have a look at one below:

The Kodak Moment: The Peril of Ignoring Technological Advancement

One of the most illustrative examples of the failure to manage strategic risk comes from the downfall of Kodak, once a titan in the photography industry. Kodak's decline was not due to operational inefficiencies but stemmed from a monumental strategic oversight: the underestimation of digital photography's potential to disrupt the film market.

Kodak, despite inventing the first digital camera in 1975, chose to sideline the technology, fearing it would cannibalize its film business. This decision illustrates a critical strategic risk—failing to adapt to technological advancements.

The consequences of this miscalculation were profound. By the time Kodak acknowledged the shift in consumer preferences towards digital photography, competitors had already secured a stronghold in the market.

Kodak's hesitation to pivot and innovate led to a loss in market share, diminishing brand value, and, eventually, bankruptcy in 2012.

It serves as a powerful testament to the importance of acknowledging and adapting to technological trends, underlining how strategic risk management is not just about sidestepping threats but also about ensuring organizational agility and resilience.

A strategic risk management framework is a structured approach adopted by organizations to identify, assess, and manage risks that could potentially impact their strategic objectives and long-term success.

It encompasses processes, methodologies, and tools aimed at aligning risk management activities with the organization's strategic goals, enabling informed decision-making and enhancing resilience in the face of uncertainties.

Some of the most well-known strategic risk management frameworks are the COSO ERM framework, NIST RMF, and ISO 31000.

Identifying strategic risks involves analyzing potential threats that could disrupt an organization’s long-term goals and overall business strategy. These risks can arise from internal operations, industry trends, or external economic and regulatory environments. The key steps to identifying strategic risks include:

1. Environmental Scanning

- Assess external factors such as market trends, competitor actions, economic changes, and technological advancements.

- Monitor political and regulatory developments that could impact business operations.

- Use industry reports, financial forecasts, and competitive intelligence tools to stay informed.

2. Internal Analysis

- Review internal processes, financial stability, and resource allocation to identify vulnerabilities.

- Evaluate operational efficiency and scalability to determine areas of potential risk.

- Conduct employee and stakeholder feedback sessions to uncover overlooked challenges.

3. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

- Identify organizational strengths and weaknesses to determine how well the company can withstand risks.

- Analyze external opportunities and threats that may affect long-term business strategy.

- Use insights to align strategic objectives with potential risk mitigation measures.

4. Scenario Planning and Stress Testing

- Develop multiple risk scenarios, including best-case, worst-case, and probable-case situations.

- Simulate the impact of major disruptions, such as supply chain failures, economic downturns, or regulatory shifts.

- Assess how the company would respond and adjust strategies accordingly.

5. Stakeholder Consultation

- Engage with key stakeholders, including executives, investors, employees, and customers, to gain diverse perspectives on potential risks.

- Consider industry partnerships and expert opinions to assess risks comprehensively.

- Ensure cross-functional collaboration to capture risks across different business areas.

6. Use of Risk Management Tools and Data Analytics

- Implement AI-driven analytics, risk assessment software, and market intelligence tools to detect emerging risks.

- Leverage historical data to predict potential threats and analyze trends.

- Continuously monitor risk indicators and adjust strategies as needed.

Strategic risks arise from various internal and external factors that can impact an organization’s ability to achieve its long-term objectives. Understanding these risk factors is crucial for effective risk management and decision-making.

1. Competitive Risks

Changes in the competitive landscape, such as new market entrants, industry disruptions, or innovative technologies, can threaten a company’s position and profitability.

2. Market and Economic Risks

Fluctuations in the economy, shifts in consumer demand, inflation, or global economic downturns can affect revenue, pricing strategies, and overall business sustainability.

3. Regulatory and Compliance Risks

Changes in government policies, industry regulations, or legal frameworks can lead to operational challenges, financial penalties, or reputational damage if not managed properly.

4. Technological Risks

Failure to keep up with technological advancements or cybersecurity threats can result in inefficiencies, data breaches, and loss of competitive advantage.

5. Reputation and Brand Risks

Negative media coverage, customer dissatisfaction, or ethical controversies can harm an organization’s credibility, reducing consumer trust and investor confidence.

6. Operational and Supply Chain Risks

Disruptions in supply chains, manufacturing failures, or inefficiencies in business processes can directly impact a company’s ability to deliver products and services effectively.

7. Strategic Execution Risks

Poor decision-making, leadership challenges, or misalignment between strategy and execution can lead to business failure or missed opportunities for growth.

By identifying and addressing these strategic risk factors, organizations can build resilience and ensure sustainable success.

Identifying strategic risks requires a systematic approach to evaluating potential threats and their impact on long-term business objectives. Here are key steps to effectively identify strategic risks:

1. Conduct a Risk Assessment

Evaluate the internal and external environment to pinpoint potential threats. Use frameworks like SWOT (Strengths, Weaknesses, Opportunities, and Threats) or PESTEL (Political, Economic, Social, Technological, Environmental, and Legal) analysis to assess risk factors.

2. Analyze Market and Industry Trends

Monitor industry shifts, competitor movements, and economic changes that could impact business strategy. Staying informed helps in anticipating risks before they become critical issues.

3. Engage Stakeholders and Leadership Teams

Involve executives, department heads, and key stakeholders in discussions about emerging risks. Their insights can help uncover vulnerabilities that may not be immediately apparent.

4. Evaluate Past Performance and Failures

Review historical data, past strategic decisions, and their outcomes to identify patterns of risk exposure. Understanding previous challenges can help mitigate future risks.

5. Scenario Planning and Stress Testing

Develop “what-if” scenarios to assess how different risks could impact the business. Conduct stress tests to understand the organization’s ability to withstand potential disruptions.

6. Utilize Risk Management Tools and Technology

Leverage risk assessment software, data analytics, and AI-driven insights to detect patterns and predict potential strategic risks before they materialize.

7. Establish Continuous Monitoring and Reporting

Risk identification is an ongoing process. Regularly reviewing risk indicators, setting up early warning systems, and adapting strategies based on real-time insights help in proactive risk management.

By integrating these practices, businesses can identify strategic risks early, develop mitigation plans, and create a more resilient and adaptable organization.

Here are actionable steps for organizations to implement strategic risk management:

Secure Buy-In from Senior Leadership and Dedicate Resources:

The first step towards implementing strategic risk management involves securing a commitment from the top. This commitment boils down to allocating the necessary resources—be it financial, human, or technological. Leadership engagement is critical to championing the initiative across the organization.

Establish a Clear Risk Management Culture Within the Organization:

Establishing and maintaining a culture that values proactive risk management can encourage openness, improve risk reporting, and ensure that all levels of the organization participate in identifying and mitigating risks. This culture is foundational for a strategic approach to risk management.

Define Roles, Responsibilities, and Accountabilities:

Organizations should define and document the roles, responsibilities, and accountabilities of employees involved in strategic risk management processes. This is important to not only streamline the process but also ensure that there are no overlaps or duplication of efforts.

Integrate Risk Management into Your Strategic Planning Process:

Risk management should not operate in silos but should be a part of the strategic planning process. This integration ensures that risks are considered in every strategic decision and that the organization's objectives are aligned with its risk appetite.

Communicate Risks Effectively Across All Organizational Levels:

Effective communication is vital for the success of strategic risk management. It involves communicating the identified risks, their potential impact, and the measures put in place to mitigate them. This transparency ensures that everyone in the organization is on the same page and can act in a coordinated manner when managing risks.

Strategic risks are inherently different from operational or financial risks due to their impact on an organization's long-term goals, competitive advantage, and overall business strategy. Unlike operational risks, which typically involve day-to-day processes or systems, and financial risks, which focus on monetary aspects like investments or liquidity, strategic risks encompass broader considerations.

These risks are intricately tied to an organization's strategic decisions, market positioning, and ability to adapt to changing environments. There are two widely used key metrics that help measure strategic risk – economic capital and risk-adjusted return on capital (RAROC):

- Economic Capital: It is the amount of capital that an organization needs in order to stay solvent given its risk profile. In other words, it is the amount of capital that can cover the potential losses resulting from risks.

- Risk-Adjusted Return on Capital (RAROC): Organizations use this metric to understand the returns on investments (ROI) in the context of the risks taken by it. It is calculated by dividing the estimated after-tax return on an initiative by its economic capital. An initiative is viable if RAROC exceeds the organization’s cost of capital.

Strategic risk management is a pivotal element in a world characterized by volatility, uncertainty, complexity, and ambiguity. Its importance can be seen across various facets of an organization. This approach fosters agility, allowing businesses to adapt to emerging risks and seize opportunities.

By anticipating and mitigating setbacks, organizations build resilience and ensure operational continuity. Robust risk management practices also enhance investor confidence, signaling sustainability and growth potential, which can attract stable and increased investment.

Here are some of the top reasons why strategic risk management is important for businesses:

- Better Risk Visibility and Foresight: An effective strategic risk management program empowers an organization to anticipate emerging risks as well as opportunities. The improved visibility enables them to stay ahead of the curve and take proactive measures to turn them into a strategic advantage.

- Enhanced Agility: This process helps organizations be more agile, enabling them to adjust their strategies in response to emerging risks and opportunities. This is crucial for staying competitive and can make the difference between thriving and merely surviving.

- Increased Resilience: Unexpected challenges and disruptions are part and parcel of the business world. Organizations equipped with a strategic approach to risk management can anticipate potential setbacks and develop strategies to mitigate them. This preparedness helps them emerge stronger, ensuring the continuity of operations even in turbulent times.

- Improved Decision-making: The comprehensive understanding of organizational risks and opportunities allows for more informed decision-making, enabling leaders to weigh the pros and cons of various paths forward. It shifts the narrative from reactive to proactive, positioning organizations to survive and thrive in the face of uncertainties.

- Boosted Investor Confidence: Investors are increasingly looking at the robustness of an organization’s risk management practices as a marker of its sustainability and growth potential. Demonstrating a commitment to comprehensive risk management can significantly enhance investor trust and confidence, potentially leading to more stable and increased investment.

Managing strategic risks requires a structured approach to identifying, assessing, and mitigating threats while ensuring business continuity. The key steps in the strategic risk management process include:

1. Risk Identification

- Identify strategic risks through environmental scanning, internal assessments, and stakeholder consultations.

- Categorize risks based on their origin — financial, operational, regulatory, technological, or market-driven.

2. Risk Assessment and Prioritization

- Evaluate risks based on their likelihood and potential impact on the organization’s strategic goals.

- Use qualitative and quantitative risk assessment techniques, such as risk matrices and financial modeling.

- Prioritize risks based on their severity and the organization’s risk tolerance.

3. Risk Mitigation and Response Planning

- Develop mitigation strategies, including contingency planning and proactive risk controls.

- Implement preventive measures such as process improvements, diversification strategies, and regulatory compliance initiatives.

- Assign responsibilities for managing each identified risk.

4. Risk Monitoring and Reporting

- Continuously track risk indicators, market developments, and internal performance metrics.

- Establish a risk governance framework with regular reporting to senior leadership and stakeholders.

- Conduct periodic reviews to reassess risks and update mitigation strategies.

5. Continuous Improvement and Adaptation

- Regularly refine risk management strategies based on new insights and changing business conditions.

- Foster a risk-aware culture within the organization through training and communication.

- Leverage technology and data analytics to enhance risk detection and response.

MetricStream Enterprise Risk Management software is a powerful solution that can help organizations streamline their strategic risk management processes. By offering an integrated risk management solution that covers risk identification, assessment, mitigation, and reporting, MetricStream simplifies these complex tasks and also ensures they are interlinked and feed into one another.

This interconnectedness is vital for organizations aiming to make strategic decisions that are informed, agile, and resilient in the face of uncertainties.

To learn more about MetricStream Enterprise Risk Management(ERM) , request a personalized demo today.

What are the steps of the strategic risk management process?

The steps of the strategic risk management process typically include the identification, assessment, prioritization, mitigation, and monitoring of strategic risks.

What are the key principles of strategic risk management?

The key principles of strategic risk management include aligning risk management with organizational objectives, fostering a risk-aware culture, integrating risk management into decision-making processes, and continuously monitoring and adapting to changes.

What is the difference between strategic risk management and enterprise risk management?

Strategic risk management focuses specifically on risks that impact an organization's strategic objectives and competitive position, whereas enterprise risk management (ERM) covers a broader spectrum of risks across all areas of an organization's operations.operations.íñ

What are examples of strategic risk?

Examples of strategic risk include market competition, regulatory changes, technological disruptions, economic downturns, reputational damage, and failed mergers or expansions.

What is the scope of strategic risk management?

The scope of strategic risk management includes identifying, assessing, and mitigating risks that impact business strategy, such as market dynamics, operational challenges, compliance issues, and long-term growth objectives.

What are the 5 risk management strategies?

The five key risk management strategies are risk avoidance, risk reduction, risk sharing (or transfer), risk retention, and risk acceptance.

What is an example of a strategic risk?

An example of a strategic risk is a company failing to adapt to new technology, leading to a competitive disadvantage and loss of market share.

What are the principles of strategic risk management?

The core principles of strategic risk management include proactive risk identification, alignment with business strategy, continuous monitoring, adaptability, and informed decision-making based on data and insights.