As the risk landscape continues to evolve, enterprise risk management is becoming an increasingly complex and demanding business function. Functions like recognizing and mitigating risks, complying with regulations, gaining increased market valuation, and optimizing the use of assets with higher returns on risk capital are now generating new risk management requirements.

This article provides a deep dive into enterprise risk management, including its key elements and aspects, critical considerations for developing and implementing a robust framework, recommended best practices and approaches, and more.

Key Takeaways

- Enterprise Risk Management (ERM) is a strategic approach to identifying, assessing, and mitigating risks that could impact an organization's ability to achieve its objectives. An effective ERM framework leads to improved decision-making and operational efficiency, and financial performance.

- An organization needs to develop a formal risk management framework that defines the scope, roles, and responsibilities, and requirements for regulator review of risk management activities and the criteria for risk acceptability.

- The role of a corporate risk manager today goes beyond managing a predetermined set of risk exposures to performing necessary walkthroughs, asking the right questions at the right time, observing key risk management components, assigning appropriate personnel at all levels, and promoting strengthened governance.

- Understanding and managing risk is imperative to succeed in a competitive environment.

- ERM platforms and tools empower the organization to improve agility, accuracy, and efficiency in making risk-based business decisions.

What is Enterprise Risk Management (ERM)?

Enterprise Risk Management is a process to systematically identify, assess, prioritize, and mitigate diverse potential risks faced by an organization to help achieve business objectives and strategic goals. ERM addresses multiple risk categories, including financial risk, operational risk, strategic risk, cyber risk, credit risk, and third-party risk.

In today's complex economy, organizations face numerous variables that impact various aspects of their operations. As a result, effective Enterprise Risk Management (ERM) is essential to navigate the evolving risk landscape.

The primary goal of Enterprise Risk Management (ERM) is to assess the potential impact of specific risks on an organization and implement appropriate measures to mitigate or avoid any resulting damage or loss.

It provides a centralized framework for comprehensively understanding and managing the entire risk landscape of an organization. It spans all stages, from the initiation to the completion of processes, projects, or activities undertaken by an organization.

Recognizing that even minor changes within the organization can have far-reaching consequences, adopting a holistic ERM approach becomes crucial. It enables organizations to make informed business decisions and ensures their sustainability well into the future.

Why is Enterprise Risk Management Important?

All organizations, regardless of their industry or market, are exposed to various risks that can have negative consequences. It plays a crucial role in identifying and recognizing potential risk areas that may impact the organization. It involves documenting risks and creating strategies, policies, and roadmaps to proactively overcome or recover from these effects.

Here are some key reasons why ERM is important:

Effective resource management:

A risk-aware organization can make accurate assumptions about its operations when faced with specific risks. ERM enables organizational preparedness and allows executives to deploy measures for better resource management, including resource preservation, efficient utilization, and future protection.

Regulatory compliance:

ERM helps companies ensure regulatory compliance with various regulatory requirements. By analyzing and addressing compliance risks, companies can prevent costly fines and legal issues resulting from non-compliance, particularly in heavily regulated industries such as finance, healthcare, and energy. ERM identifies potential compliance risks and helps implement controls to mitigate them.

Achieving strategic goals:

ERM provides companies with confidence in achieving strategic goals by identifying and mitigating potential risks that could hinder progress. It also helps identify growth opportunities and potential threats that may impact success.

Improved efficiency:

ERM improves efficiency by identifying and addressing potential issues before they arise. This reduces the time and resources spent on problem-solving, avoids costly disruptions and unplanned downtime, and enhances operational efficiency and profitability.

Positive risk culture:

A positive risk culture is fostered when employees at all levels understand the importance of risk management and actively identify and address risks. ERM provides tools and resources to develop and maintain a positive risk culture, enabling effective risk management.

Preparedness for audits:

Companies with a strong ERM program are better prepared for audits and regulatory inspections. This helps avoid negative findings, and penalties, and demonstrates commitment to good governance and compliance. ERM anticipates and prepares for audits by identifying areas of risk and implementing controls. Ensuring business continuity: ERM frameworks enable organizations to create roadmaps and recovery plans to sustain business continuity in the face of realized risks.

Ensuring business continuity:

Today, principles of business continuity and resilience are being increasingly embedded into the ERM framework to implement an integrated approach. This enables organizations to create comprehensive roadmaps and recovery plans to sustain business continuity in the face of realized risks.

What is an Enterprise Risk Management (ERM) Framework?

An ERM framework is a comprehensive set of processes that enable organizations to manage their risks effectively. The framework helps businesses organize their risk management efforts and establish practices as well as policies that help with effective ERM.

Here are some of the widely used ERM frameworks:

1. COSO ERM Framework

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) published Enterprise Risk Management—Integrated Framework in 2004 to enable organizations to better protect and enhance stakeholder value. To help organizations keep up with the changing risk landscape and address the needs of the modern enterprise, the commission published a revised version of the framework, Enterprise Risk Management—Integrating with Strategy and Performance, in 2017.

The updated version details five interrelated components:

1. Governance and Culture: It emphasizes the importance of establishing a robust governance structure and cultivating a risk-aware culture. This involves setting the tone at the top, defining organizational values, and ensuring that risk management roles and responsibilities are clearly delineated. It ensures that risk management is embedded in the organizational culture and decision-making processes.

2. Strategy and Objective-Setting: It focuses on integrating risk management with strategic planning. This is essentially defining the organization’s risk appetite and aligning risk management objectives with business goals.

3. Performance: It involves identifying and assessing risks that could impact the achievement of strategic objectives. It encompasses risk prioritization, risk response strategies, and performance measurement.

4. Review and Revision: The fourth component ensures that the risk management process is dynamic and continuously improving. At this stage, the effectiveness of risk management practices is evaluated and necessary adjustments are made accordingly.

5. Information, Communication, and Reporting: The last component emphasizes the importance of timely and transparent communication of risk information across the organization, ensuring that stakeholders are informed and can make well-informed decisions.

2. NIST RMF

Developed by the National Institute of Standards and Technology, the NIST Risk Management Framework provides a more specialized approach, particularly geared towards federal information systems in the United States but widely respected and adopted across various sectors globally for its rigorous cybersecurity focus.

The NIST RMF is detailed in its methodology, consisting of a 7-step process:

1. Preparing the organization

2. Categorizing the information system

3. Selecting appropriate security controls

4. Implementing those control

5. Assessing the implementation to ensure it meets the required standards

6. Authorizing the information system for operation

7. Continuously monitoring its security

This comprehensive process ensures that all aspects of risk management are addressed, from initial preparation to ongoing monitoring.

What distinguishes the NIST RMF is its emphasis on integrating risk management into the system development life cycle, embedding it within an organization’s governance structure. This integration ensures that risk management is not a one-time activity but an ongoing process that evolves with the organization and its technology landscape.

3. ISO 31000

ISO 31000, developed by the International Organization for Standardization (ISO), represents a gold standard in risk management principles and guidelines. This framework is universally applicable and designed to suit organizations of all types and sizes across various industries. Its beauty lies in its flexibility; it doesn't prescribe a one-size-fits-all model but encourages organizations to tailor risk management practices to their unique circumstances, objectives, and risk profile.

The ISO 31000 framework is composed of six distinct areas:

1. Leadership, which ensures top management commitment and accountability

2. Integration, which embeds risk management into organizational processes

3. Design, focusing on crafting a risk management strategy aligned with organizational goals

4. Implementation, which involves putting the risk management plan into action

5. Evaluation, to monitor and assess the effectiveness of risk management processes

6. Improvement, which promotes continuous enhancement of the risk management framework based on feedback and changing conditions.

This framework is centered around creating, and enhancing value for the organization, promoting a culture of informed risk-taking, and ensuring that every decision-maker is equipped with a clear understanding of risks and their potential impacts.

What are the Steps of an ERM Process?

Here are the key steps of an effective enterprise risk management process:

Clearly define goals:

ERM requires organizations to establish clear goals that align with their overall objectives. These goals enable the organization to make informed assumptions and projections about future operations and performance. It is crucial for organizations to understand why they need ERM and set expectations for the exercise to achieve the desired results.

Develop and implement policies:

Organizations must develop and implement policies that translate the outcomes of the ERM framework into actionable measures. These policies help guide the organization in identifying and mitigating risks effectively. Policies should be well-defined and provide guidelines on risk management practices, ensuring consistency and adherence to the framework.

Determine risk appetite:

Organizations should have a clear understanding of their risk appetite before making business decisions. Risk appetite defines the level of risk that the organization is willing to accept, the threshold beyond which risks become damaging, and the level of risk that is considered unmanageable. Defining risk appetite helps organizations align their risk management strategies with their overall risk tolerance.

Identify risks:

A comprehensive risk identification process is crucial for effective ERM. Organizations need to analyze all aspects of their business operations and the market to identify potential risks. These risks should be categorized and documented in a risk universe. Identifying and categorizing risks allows organizations to prioritize and focus their risk management efforts effectively. It is important to note that the first line of defense plays a key role in the risk identification process as it is closely involved in day-to-day business operations.

Assess and prioritize risks:

Risk assessment is a critical step in ERM. The ERM framework emphasizes the assessment of risks by evaluating their likelihood and financial impact. Organizations should evaluate the probability of risks occurring, the potential damage they can cause, and the priority in which they should be addressed. Risk assessment helps organizations understand the impact of risks on their overall risk profile and enables them to allocate resources accordingly.

Determine risk response strategies:

Risk response strategies help organizations mitigate or minimize the effects of risk materialization. It is essential to document risk treatment plans to ensure consistent and effective execution of response strategies. Organizations can respond to risks in four ways:

- Risk Avoidance: The company chooses to avoid the risk by discontinuing the activity causing the risk, and sacrificing the associated benefits.

- Risk Reduction: The company remains engaged in the activity but takes measures to minimize the likelihood or magnitude of the risk, such as investing in quality control or consumer education.

- Risk Sharing: The company accepts the current risk profile and involves an independent third party to share potential losses in exchange for a fee, typically through insurance policies.

- Risk Acceptance: The company analyzes potential outcomes and decides whether it is financially viable to pursue risk mitigation practices without making significant changes to operations.

Control Activities

Control activities refer to the actions taken by a company to establish policies and procedures that enable management to conduct operations while mitigating risk. These internal controls can be categorized into two types:

- Preventative Control Activities: Measures put in place to prevent certain events from occurring, reducing risk. For example, physical locks or keypads restricting access to sensitive areas.

- Detective Control Activities: Measures aimed at recognizing risky actions that have taken place, allowing management to take appropriate follow-up steps. For instance, alarms or surveillance systems.

Monitor risks and controls:

Continuous monitoring of the organizational risk profile is crucial for adapting to the evolving nature of risks. While risks have been identified, assessed, and responded to, they need to be regularly monitored and reassessed. This allows organizations to stay proactive and adjust their action plans as the business landscape changes. Periodic and agile risk assessments enable organizations to keep up with emerging risks and take timely preventive measures.

Likewise, continuous monitoring of controls helps organizations to proactively identify any gaps or weaknesses and address them in a timely manner.

Foster effective communication:

Communication is a critical component of any ERM exercise. Organizations must ensure transparent and effective communication of risk information to all relevant parties. This promotes awareness and understanding of risks, facilitates consistent implementation of risk management practices, and enables timely and appropriate responses to risk realization.

Harness the Power of Technology:

ERM platforms offer the capability to store, condense, and monitor a multitude of risks faced by a company, automate repeatable tasks, and improve agility and accuracy in decision-making. Advanced technologies, such as artificial intelligence, can provide valuable insights into risk trends and patterns, recommendations for optimizing the control environments, and more. They also help free up the bandwidth of the risk teams to focus on other critical areas instead spending time on analyzing troves of data.

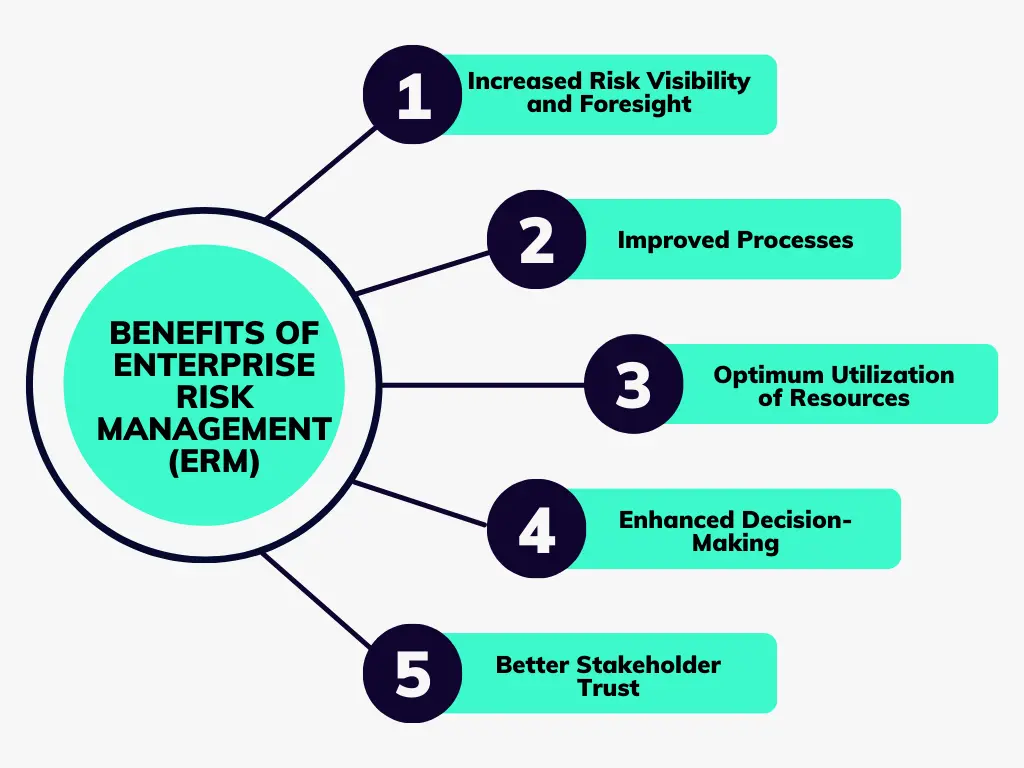

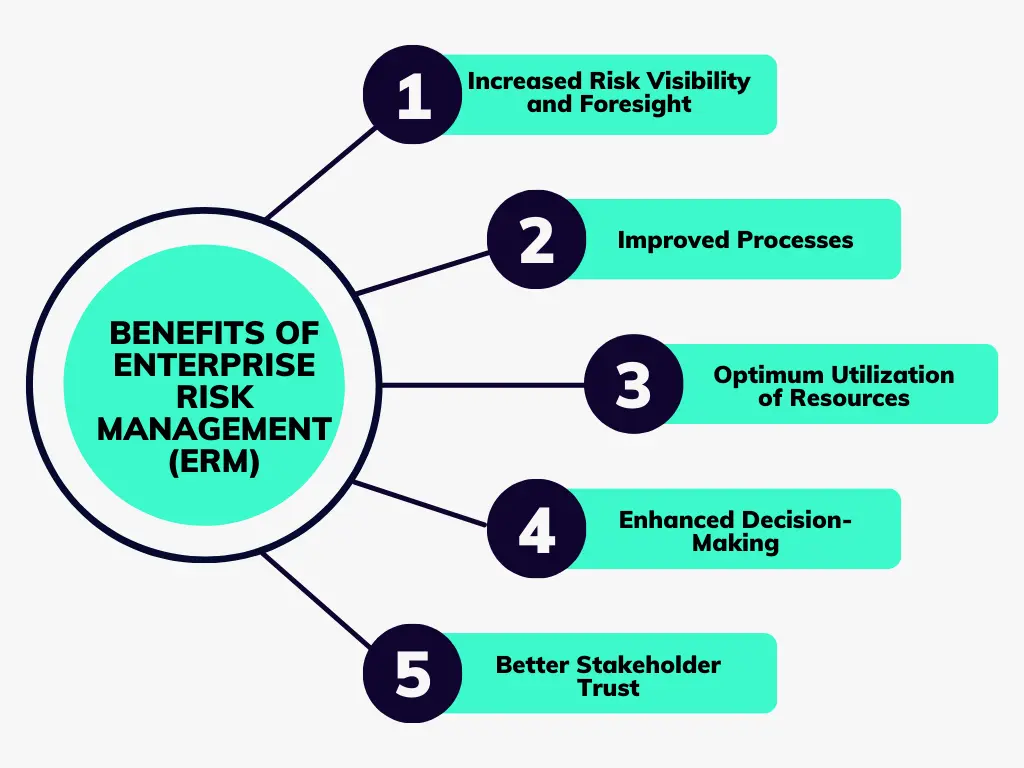

What are the Benefits of ERM?

Here are the five key benefits of an ERM program:

Increased Risk Visibility and Foresight:

A robust ERM program, supported by a technology-based software solution, can significantly improve an organization’s visibility into existing and emerging risks.

Improved Processes:

By enabling an organization to proactively identify, assess, and mitigate risks, ERM creates a transparent environment where decisions are based on hard facts and metrics.

Optimum Utilization of Resources:

Organizations can optimize the allocation and utilization of resources as ERM helps them prioritize risks and align business decisions with organizational risk appetite.

Enhanced Decision-Making:

ERM helps an organization stay on top of the evolving risk landscape, make risk-aware business decisions, and turn risks into a strategic advantage.

Better Stakeholder Trust:

A strong ERM program also helps an organization build trust and confidence with the board, regulators, investors, and other stakeholders by demonstrating a proactive approach to identifying and mitigating risks.

How MetricStream Can Help?

With MetricStream Enterprise Risk Management software, organizations can adopt a systematic approach to effectively manage enterprise risks. The solution’s consistent risk assessment methodologies and standards help gain a precise understanding of risk exposure across various levels of the enterprise. Risk teams can conduct comprehensive risk and control assessments using qualitative and quantitative parameters to establish a comprehensive risk profile. By providing real-time insights into your risk management processes through robust analytics, advanced heat maps, reports, dashboards, and charts, the software empowers organizations to make informed decisions that are aligned with risk awareness and intelligence.

With MetricStream ERM software, organizations can:

- Cut down the cycle time and costs of performing risk assessments and improve resource utilization

- Gain a 360-degree view of the organizational risk profile, which helps enhance agility and risk-aware decision-making

- Improve risk visibility and foresight with predictive risk metrics and indicators that help anticipate and prepare for adverse risk events

- Strengthen confidence and trust with key business stakeholders by demonstrating a strong risk data governance and issue reporting framework.

FAQ

1. What is the difference between risk management and enterprise risk management?

While risk management historically has referred to the practices and policies focused on addressing specific risks faced by a company, ERM is a broader and more recent concept that encompasses all the risks an organization is exposed to and promotes an integrated approach to risk management.

ERM typically categorizes risks into three main types: operational, financial, and strategic risks. Operational risks impact the day-to-day functioning of a company, while strategic risks have long-term implications on the company's plans and objectives. Financial risks pertain to the overall financial stability and well-being of the company.

2. What are the various types of enterprise risks?

Enterprise risks include various types of risks faced by an organization including strategic risk, financial risk, operational risk, compliance risk, cyber risk, third-party risk, and reputational risk.

As the risk landscape continues to evolve, enterprise risk management is becoming an increasingly complex and demanding business function. Functions like recognizing and mitigating risks, complying with regulations, gaining increased market valuation, and optimizing the use of assets with higher returns on risk capital are now generating new risk management requirements.

This article provides a deep dive into enterprise risk management, including its key elements and aspects, critical considerations for developing and implementing a robust framework, recommended best practices and approaches, and more.

Key Takeaways

- Enterprise Risk Management (ERM) is a strategic approach to identifying, assessing, and mitigating risks that could impact an organization's ability to achieve its objectives. An effective ERM framework leads to improved decision-making and operational efficiency, and financial performance.

- An organization needs to develop a formal risk management framework that defines the scope, roles, and responsibilities, and requirements for regulator review of risk management activities and the criteria for risk acceptability.

- The role of a corporate risk manager today goes beyond managing a predetermined set of risk exposures to performing necessary walkthroughs, asking the right questions at the right time, observing key risk management components, assigning appropriate personnel at all levels, and promoting strengthened governance.

- Understanding and managing risk is imperative to succeed in a competitive environment.

- ERM platforms and tools empower the organization to improve agility, accuracy, and efficiency in making risk-based business decisions.

Enterprise Risk Management is a process to systematically identify, assess, prioritize, and mitigate diverse potential risks faced by an organization to help achieve business objectives and strategic goals. ERM addresses multiple risk categories, including financial risk, operational risk, strategic risk, cyber risk, credit risk, and third-party risk.

In today's complex economy, organizations face numerous variables that impact various aspects of their operations. As a result, effective Enterprise Risk Management (ERM) is essential to navigate the evolving risk landscape.

The primary goal of Enterprise Risk Management (ERM) is to assess the potential impact of specific risks on an organization and implement appropriate measures to mitigate or avoid any resulting damage or loss.

It provides a centralized framework for comprehensively understanding and managing the entire risk landscape of an organization. It spans all stages, from the initiation to the completion of processes, projects, or activities undertaken by an organization.

Recognizing that even minor changes within the organization can have far-reaching consequences, adopting a holistic ERM approach becomes crucial. It enables organizations to make informed business decisions and ensures their sustainability well into the future.

All organizations, regardless of their industry or market, are exposed to various risks that can have negative consequences. It plays a crucial role in identifying and recognizing potential risk areas that may impact the organization. It involves documenting risks and creating strategies, policies, and roadmaps to proactively overcome or recover from these effects.

Here are some key reasons why ERM is important:

Effective resource management:

A risk-aware organization can make accurate assumptions about its operations when faced with specific risks. ERM enables organizational preparedness and allows executives to deploy measures for better resource management, including resource preservation, efficient utilization, and future protection.

Regulatory compliance:

ERM helps companies ensure regulatory compliance with various regulatory requirements. By analyzing and addressing compliance risks, companies can prevent costly fines and legal issues resulting from non-compliance, particularly in heavily regulated industries such as finance, healthcare, and energy. ERM identifies potential compliance risks and helps implement controls to mitigate them.

Achieving strategic goals:

ERM provides companies with confidence in achieving strategic goals by identifying and mitigating potential risks that could hinder progress. It also helps identify growth opportunities and potential threats that may impact success.

Improved efficiency:

ERM improves efficiency by identifying and addressing potential issues before they arise. This reduces the time and resources spent on problem-solving, avoids costly disruptions and unplanned downtime, and enhances operational efficiency and profitability.

Positive risk culture:

A positive risk culture is fostered when employees at all levels understand the importance of risk management and actively identify and address risks. ERM provides tools and resources to develop and maintain a positive risk culture, enabling effective risk management.

Preparedness for audits:

Companies with a strong ERM program are better prepared for audits and regulatory inspections. This helps avoid negative findings, and penalties, and demonstrates commitment to good governance and compliance. ERM anticipates and prepares for audits by identifying areas of risk and implementing controls. Ensuring business continuity: ERM frameworks enable organizations to create roadmaps and recovery plans to sustain business continuity in the face of realized risks.

Ensuring business continuity:

Today, principles of business continuity and resilience are being increasingly embedded into the ERM framework to implement an integrated approach. This enables organizations to create comprehensive roadmaps and recovery plans to sustain business continuity in the face of realized risks.

An ERM framework is a comprehensive set of processes that enable organizations to manage their risks effectively. The framework helps businesses organize their risk management efforts and establish practices as well as policies that help with effective ERM.

Here are some of the widely used ERM frameworks:

1. COSO ERM Framework

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) published Enterprise Risk Management—Integrated Framework in 2004 to enable organizations to better protect and enhance stakeholder value. To help organizations keep up with the changing risk landscape and address the needs of the modern enterprise, the commission published a revised version of the framework, Enterprise Risk Management—Integrating with Strategy and Performance, in 2017.

The updated version details five interrelated components:

1. Governance and Culture: It emphasizes the importance of establishing a robust governance structure and cultivating a risk-aware culture. This involves setting the tone at the top, defining organizational values, and ensuring that risk management roles and responsibilities are clearly delineated. It ensures that risk management is embedded in the organizational culture and decision-making processes.

2. Strategy and Objective-Setting: It focuses on integrating risk management with strategic planning. This is essentially defining the organization’s risk appetite and aligning risk management objectives with business goals.

3. Performance: It involves identifying and assessing risks that could impact the achievement of strategic objectives. It encompasses risk prioritization, risk response strategies, and performance measurement.

4. Review and Revision: The fourth component ensures that the risk management process is dynamic and continuously improving. At this stage, the effectiveness of risk management practices is evaluated and necessary adjustments are made accordingly.

5. Information, Communication, and Reporting: The last component emphasizes the importance of timely and transparent communication of risk information across the organization, ensuring that stakeholders are informed and can make well-informed decisions.

2. NIST RMF

Developed by the National Institute of Standards and Technology, the NIST Risk Management Framework provides a more specialized approach, particularly geared towards federal information systems in the United States but widely respected and adopted across various sectors globally for its rigorous cybersecurity focus.

The NIST RMF is detailed in its methodology, consisting of a 7-step process:

1. Preparing the organization

2. Categorizing the information system

3. Selecting appropriate security controls

4. Implementing those control

5. Assessing the implementation to ensure it meets the required standards

6. Authorizing the information system for operation

7. Continuously monitoring its security

This comprehensive process ensures that all aspects of risk management are addressed, from initial preparation to ongoing monitoring.

What distinguishes the NIST RMF is its emphasis on integrating risk management into the system development life cycle, embedding it within an organization’s governance structure. This integration ensures that risk management is not a one-time activity but an ongoing process that evolves with the organization and its technology landscape.

3. ISO 31000

ISO 31000, developed by the International Organization for Standardization (ISO), represents a gold standard in risk management principles and guidelines. This framework is universally applicable and designed to suit organizations of all types and sizes across various industries. Its beauty lies in its flexibility; it doesn't prescribe a one-size-fits-all model but encourages organizations to tailor risk management practices to their unique circumstances, objectives, and risk profile.

The ISO 31000 framework is composed of six distinct areas:

1. Leadership, which ensures top management commitment and accountability

2. Integration, which embeds risk management into organizational processes

3. Design, focusing on crafting a risk management strategy aligned with organizational goals

4. Implementation, which involves putting the risk management plan into action

5. Evaluation, to monitor and assess the effectiveness of risk management processes

6. Improvement, which promotes continuous enhancement of the risk management framework based on feedback and changing conditions.

This framework is centered around creating, and enhancing value for the organization, promoting a culture of informed risk-taking, and ensuring that every decision-maker is equipped with a clear understanding of risks and their potential impacts.

Here are the key steps of an effective enterprise risk management process:

Clearly define goals:

ERM requires organizations to establish clear goals that align with their overall objectives. These goals enable the organization to make informed assumptions and projections about future operations and performance. It is crucial for organizations to understand why they need ERM and set expectations for the exercise to achieve the desired results.

Develop and implement policies:

Organizations must develop and implement policies that translate the outcomes of the ERM framework into actionable measures. These policies help guide the organization in identifying and mitigating risks effectively. Policies should be well-defined and provide guidelines on risk management practices, ensuring consistency and adherence to the framework.

Determine risk appetite:

Organizations should have a clear understanding of their risk appetite before making business decisions. Risk appetite defines the level of risk that the organization is willing to accept, the threshold beyond which risks become damaging, and the level of risk that is considered unmanageable. Defining risk appetite helps organizations align their risk management strategies with their overall risk tolerance.

Identify risks:

A comprehensive risk identification process is crucial for effective ERM. Organizations need to analyze all aspects of their business operations and the market to identify potential risks. These risks should be categorized and documented in a risk universe. Identifying and categorizing risks allows organizations to prioritize and focus their risk management efforts effectively. It is important to note that the first line of defense plays a key role in the risk identification process as it is closely involved in day-to-day business operations.

Assess and prioritize risks:

Risk assessment is a critical step in ERM. The ERM framework emphasizes the assessment of risks by evaluating their likelihood and financial impact. Organizations should evaluate the probability of risks occurring, the potential damage they can cause, and the priority in which they should be addressed. Risk assessment helps organizations understand the impact of risks on their overall risk profile and enables them to allocate resources accordingly.

Determine risk response strategies:

Risk response strategies help organizations mitigate or minimize the effects of risk materialization. It is essential to document risk treatment plans to ensure consistent and effective execution of response strategies. Organizations can respond to risks in four ways:

- Risk Avoidance: The company chooses to avoid the risk by discontinuing the activity causing the risk, and sacrificing the associated benefits.

- Risk Reduction: The company remains engaged in the activity but takes measures to minimize the likelihood or magnitude of the risk, such as investing in quality control or consumer education.

- Risk Sharing: The company accepts the current risk profile and involves an independent third party to share potential losses in exchange for a fee, typically through insurance policies.

- Risk Acceptance: The company analyzes potential outcomes and decides whether it is financially viable to pursue risk mitigation practices without making significant changes to operations.

Control Activities

Control activities refer to the actions taken by a company to establish policies and procedures that enable management to conduct operations while mitigating risk. These internal controls can be categorized into two types:

- Preventative Control Activities: Measures put in place to prevent certain events from occurring, reducing risk. For example, physical locks or keypads restricting access to sensitive areas.

- Detective Control Activities: Measures aimed at recognizing risky actions that have taken place, allowing management to take appropriate follow-up steps. For instance, alarms or surveillance systems.

Monitor risks and controls:

Continuous monitoring of the organizational risk profile is crucial for adapting to the evolving nature of risks. While risks have been identified, assessed, and responded to, they need to be regularly monitored and reassessed. This allows organizations to stay proactive and adjust their action plans as the business landscape changes. Periodic and agile risk assessments enable organizations to keep up with emerging risks and take timely preventive measures.

Likewise, continuous monitoring of controls helps organizations to proactively identify any gaps or weaknesses and address them in a timely manner.

Foster effective communication:

Communication is a critical component of any ERM exercise. Organizations must ensure transparent and effective communication of risk information to all relevant parties. This promotes awareness and understanding of risks, facilitates consistent implementation of risk management practices, and enables timely and appropriate responses to risk realization.

Harness the Power of Technology:

ERM platforms offer the capability to store, condense, and monitor a multitude of risks faced by a company, automate repeatable tasks, and improve agility and accuracy in decision-making. Advanced technologies, such as artificial intelligence, can provide valuable insights into risk trends and patterns, recommendations for optimizing the control environments, and more. They also help free up the bandwidth of the risk teams to focus on other critical areas instead spending time on analyzing troves of data.

Here are the five key benefits of an ERM program:

Increased Risk Visibility and Foresight:

A robust ERM program, supported by a technology-based software solution, can significantly improve an organization’s visibility into existing and emerging risks.

Improved Processes:

By enabling an organization to proactively identify, assess, and mitigate risks, ERM creates a transparent environment where decisions are based on hard facts and metrics.

Optimum Utilization of Resources:

Organizations can optimize the allocation and utilization of resources as ERM helps them prioritize risks and align business decisions with organizational risk appetite.

Enhanced Decision-Making:

ERM helps an organization stay on top of the evolving risk landscape, make risk-aware business decisions, and turn risks into a strategic advantage.

Better Stakeholder Trust:

A strong ERM program also helps an organization build trust and confidence with the board, regulators, investors, and other stakeholders by demonstrating a proactive approach to identifying and mitigating risks.

With MetricStream Enterprise Risk Management software, organizations can adopt a systematic approach to effectively manage enterprise risks. The solution’s consistent risk assessment methodologies and standards help gain a precise understanding of risk exposure across various levels of the enterprise. Risk teams can conduct comprehensive risk and control assessments using qualitative and quantitative parameters to establish a comprehensive risk profile. By providing real-time insights into your risk management processes through robust analytics, advanced heat maps, reports, dashboards, and charts, the software empowers organizations to make informed decisions that are aligned with risk awareness and intelligence.

With MetricStream ERM software, organizations can:

- Cut down the cycle time and costs of performing risk assessments and improve resource utilization

- Gain a 360-degree view of the organizational risk profile, which helps enhance agility and risk-aware decision-making

- Improve risk visibility and foresight with predictive risk metrics and indicators that help anticipate and prepare for adverse risk events

- Strengthen confidence and trust with key business stakeholders by demonstrating a strong risk data governance and issue reporting framework.

1. What is the difference between risk management and enterprise risk management?

While risk management historically has referred to the practices and policies focused on addressing specific risks faced by a company, ERM is a broader and more recent concept that encompasses all the risks an organization is exposed to and promotes an integrated approach to risk management.

ERM typically categorizes risks into three main types: operational, financial, and strategic risks. Operational risks impact the day-to-day functioning of a company, while strategic risks have long-term implications on the company's plans and objectives. Financial risks pertain to the overall financial stability and well-being of the company.

2. What are the various types of enterprise risks?

Enterprise risks include various types of risks faced by an organization including strategic risk, financial risk, operational risk, compliance risk, cyber risk, third-party risk, and reputational risk.