Introduction

No organization is risk free. There have been several incidents in the past when frauds have led to the downfall of organizations as a whole. As the global business landscape continues to evolve, it is essential for organizations to adapt their control environment accordingly to ensure they are relevant and effective.

Realizing the significant changes to business and operating environments, the Committee of Sponsoring Organizations of the Treadway Commission (COSO) issued the Internal Control-Integrated Framework to help organizations improve confidence in all types of data and information.

In this article, we will discuss the COSO framework, its scope, key requirements, advantages and limitations, how to achieve compliance, and more.

Key Takeaways

- The COSO Framework is a comprehensive approach that helps organizations manage their internal control and risk management.

- The COSO Internal Control—Integrated Framework (ICIF) was originally issued in 1992 to provide guidance to organizations for designing, implementing, and conducting a system of internal controls and assessing its effectiveness. The framework was last updated in 2013.

- The whole purpose of updating the framework was to increase its relevance in the increasingly complex and global business environment. The 17 principles, under the five components, of the COSO 2013 ICIF are presumed relevant for all entities and need to be present and functioning to have effective internal controls.

- For ensuring compliance with the COSO framework, organizations must have all five components working optimally and in an integrated manner, the ability to predict and prepare for external factors that could prevent it from achieving its objectives, and compliance with all laws, regulations, and industry standards.

What is COSO?

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) was established as an independent private-sector initiative to provide thought leadership through the development of comprehensive frameworks and guidance on enterprise risk management, internal control, and fraud deterrence to improve organizational performance and governance, and to reduce the extent of fraud in organizations.

The Internal Control-Integrated Framework (ICIF) and the Enterprise Risk Management (ERM) Framework are the two main frameworks issued by the committee. In 2024, COSO announced efforts to develop its third framework focused on Corporate Governance.

What is the COSO Framework?

The COSO Framework is a system for establishing internal controls that are integrated into business processes. Collectively, these controls provide reasonable assurance that the organization is operating ethically, transparently, and in accordance with established industry standards.

The COSO Internal Control-Integrated Framework (ICIF), or the COSO Framework, was issued in 1992 to provide guidance to organizations for embedding comprehensive internal controls into business processes for ensuring ethical and transparent operations aligned with industry standards.

The framework was created by the Executive Vice President of the committee in association with private organizations, including the American Accounting Association, Financial Executives International, the Institute of Internal Auditors, American Institute of Certified Public Accountants, and the Institute of Management Accountants (formerly the National Association of Cost Accountants).

The framework is used extensively by organizations in the US to ensure compliance with the Foreign Corrupt Practices Act (FCPA) and with Section 404 of the Sarbanes-Oxley Act of 2001 (SOX). It was updated in 2013 with the objective of ensuring that organizations could continue to design, implement, and assess internal controls efficiently within an increasingly complex business environment:

The 2013 update included a 3D diagram – the COSO Cube, which showcases the interrelated nature of all the factors that comprise the internal control system.

In 2023, the committee published additional guidance for organizations to achieve effective internal control over sustainability reporting (ICSR), using the globally recognized COSO ICIF.

Who is Covered Under the COSO Framework?

The COSO framework is extensively used by:

- Publicly traded companies

- Accounting firms

- Financial services firms

The framework is not mandatory for private companies but is a useful tool for improving internal controls for effective risk management.

According to COSO, internal controls are “a process, effected by an entity’s board of directors, management, and other personnel, designed to provide reasonable assurance regarding the achievement of objectives relating to operations, reporting, and compliance.”

What are the Key Requirements of the COSO Framework?

The COSO framework lays out 3 key goals for internal controls:

| Operations | Reporting | Compliance |

|---|---|---|

| Internal controls must be applied to day-to-day processes and practices within the organization – fraud prevention, performance objectives, business efficiency measuresmeasures | Reporting is a key focus area for internal controls and includes internal as well as external reporting. It also includes both financial and non-financial reporting. The objective here is to ensure transparency, reliability, and relevance of the organization’s internal controls and reporting practices. | Compliance with legal requirements and guidelines and adherence with established industry norms is a key objective of the COSO framework |

Components of the COSO Framework

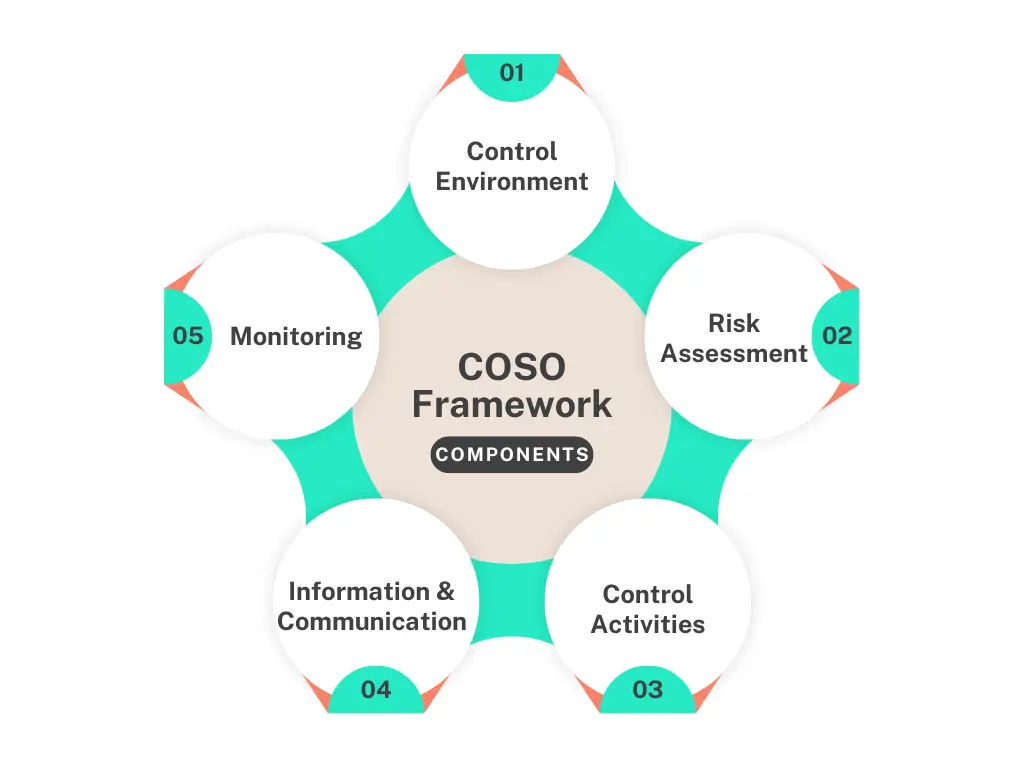

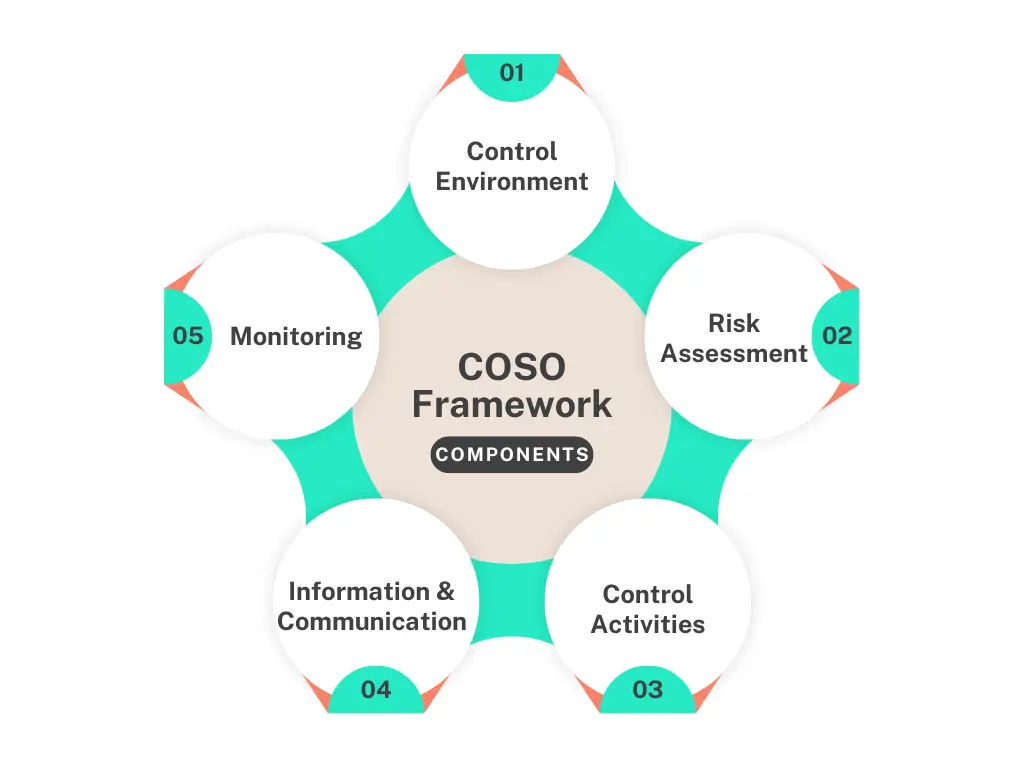

Based on these 3 objectives, the COSO Framework comprises 5 key components and 17 key principles.

Control Environment

The objective of this component is to ensure that all business practices and processes align with industry standards. It is important for running the business ethically and responsibly. A strong control environment can help an organization ensure that is compliant with regulatory requirements. It includes five key principles:

- The organization demonstrates a commitment to integrity and ethical values

- The board of directors demonstrates independence from management and oversees the development and performance of internal controls

- Management, with board oversight, establishes structure, authority, and responsibilities to achieve control objectives

- The organization demonstrates a commitment to the recruitment, development, and retention of capable, competent individuals

- The organization establishes accountability for individuals with regard to their internal control responsibilities

Risk Assessment

All businesses involve some amount of risk and the second component of the COSO framework builds on the idea that enterprise risk management is essential for managing the negative impact of risks. Key principles under this component are:

- The organization specifies clearly specifies objectives to enable identification and assessment of risks relating to objectives

- The organization identifies risks to the achievement of objectives and assesses risks to determine how they should be managed

- The organization considers the potential for fraud in assessing risk

- The organization identifies and assesses significant changes that could impact system of internal controls

Control Activities

Control activities are related to the risk management component. This component refers to internal controls that are established to ensure business processes are designed and executed in a way that the organization can achieve its goals without incurring any risks. This component includes 3 key principles:

- The organization selects and develops control activities for addressing and mitigating risks

- The organization selects and develops general controls over technology

- The organization implement policies and procedures that define control activities

Information & Communication

Timely dissemination of information to key stakeholders is critical for a robust internal controls program. It is also a key requirement for various regulations and industry standards. This component includes three key principles:

- The organization acquires or generates and uses relevant, quality information that support the functioning of internal controls

- The organization communicates relevant information internally

- The organization communicates externally, when required

Monitoring

The COSO framework places considerable importance on monitoring of processes and controls. Monitoring is essential for proactively identifying gaps or weaknesses in the control environment and addressing them in a timely manner. Key principles under this component are:

- The organization selects, develops, and performs ongoing and separate evaluations to ensure that all the components of internal controls are functioning as intended

- The organization evaluates and communicates deficiencies to relevant stakeholders for taking corrective action

Points of Focus

The revised framework outlined some points of focus to improve the understanding of each component. These are:

- It covers all divisions and structures of the organization and its ecosystem for achieving the objectives. This includes operating units, legal entities, geographic spread, distribution networks and third-party partners.

- It creates and evaluates reporting lines to manage activities.

- It delegates authority, defines the terms of authority and limits responsibilities.

The COSO Cube

The COSO Cube demonstrates the interconnectedness of an organization’s internal controls system and the relationship between each component.

The COSO Cube demonstrates the interconnectedness of an organization’s internal controls system and the relationship between each component.

What are the Advantages and Limitations of the COSO Framework?

Adherence to the COSO Framework offers a number of advantages:

- It standardizes the functioning of business processes in accordance with the internal controls.

- Well-designed internal controls systems can help reduce risks and improve operational efficiency.

- An organization that fully deploys the COSO framework is better equipped to identify and remediate fraudulent activity – both external and internal.

- As a result of COSO’s focus on operations, organizations can improve process efficiency and reduce costs.

There are also some limitations to implementing the COSO framework.

- Its broad scope and definition allow a wide range of companies to use it. But it lacks prescriptive guidance.

- The structure of the framework can be difficult to implement. It is divided into discrete categories, but organizations may find one or processes that either don’t align with any category or fall under multiple categories.

- The framework emphasizes fraud prevention and risk mitigation but cannot eliminate the risk of incidents caused by human error and external events.

How to Achieve COSO Compliance?

Here are a few measures that can help organizations achieve compliance with the COSO framework:

Role of Internal Audit

The internal audit team has a crucial role to play in helping the organization to achieve compliance with the COSO framework. The audit committee, internal audit team, and other risk management teams must work together to implement an integrated strategy to understand the state of COSO compliance, identify the gaps, and define a roadmap for implementing the transition quickly and efficiently. The team must also review and update audit plans.

The internal audit team has to leverage the right technology solutions and use them as enablers for greater transparency and accountability for internal control and various internal audit functions. The COSO framework provides a new opportunity for internal audit committees to take a fresh look at internal control, create value for the organization and manage elevated expectations regarding internal control.

Technology Support and Implementation

By leveraging technology, organizations can simplify the process of designing, assessing, and enhancing internal controls and evaluate their efficiency. It will also help record and store data pertaining to internal controls testing by internal auditors to present during external audits.

Centralized Approach

Organizations should create and maintain a centralized repository to document and record internal controls and define their relationships with assets, risks, policies, regulatory requirements, etc. This centralized approach helps eliminate silos to provide 360-degree visibility into compliance issues, status, and plans.

Comprehensive Risk Assessments

It is essential to devise a sound risk assessment plan based on likelihood and impact. Risk teams should create a plan for the tests that must be implemented for each vulnerable area to ensure better protection.

Continuous Monitoring and Reporting

Organizations should simplify and automate monitoring and reporting functionalities with robust internal control design, clearly designated responsibilities, and testing plans.

How Does MetricStream Help with the COSO Framework Compliance?

MetricStream empowers organizations to create, evaluate, and enhance internal controls in line with the COSO framework. It facilitates the establishment of a structured approach for assessing the efficiency of internal controls and simplifies the process of furnishing evidence to external auditors that an internal control was adequately tested by the audit team. With MetricStream, organizations gain better control over and visibility into compliance posture, related issues, and statuses.

With MetricStream, you can:

- Ensure a unified approach for managing risk and control data across financial processes leading to greater confidence in SOX compliance

- Leverage rationalized controls resulting in reduced compliance costs and efforts

- Streamline processes for control testing, documentation, and issue remediation, ensuring consistency

- Facilitate accurate and reliable data on control testing, certifications, and issue resolution to improve stakeholder confidence

To learn more about how MetricStream can help with IT compliance management, request a personalized product demo.

FAQ

What are the 5 components of the COSO framework?

The five components of the COSO framework are control environment, risk assessment, control activities, information and communication, and monitoring.

What is the COSO Internal Control-Integrated Framework?

The Internal Control-Integrated Framework, commonly known as the COSO framework, is the framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) to provide guidance to companies for designing, implementing, and conducting internal controls and assessing their effectiveness. It was originally issued in 1992 and then updated twice in 2013 and 2017.

How do organizations use the COSO framework?

Organizations use the COSO framework to ensure that their internal control systems adapt easily to the evolving business environments and requirements, effectively mitigate risks, and drive sound decision-making.

What is the COSO framework process?

The COSO framework process is a structural approach to implement, design, and c ontrol the organization’s internal controls.

What are the objectives of the COSO framework?

The objectives of the COSO framework is to manage the risks while strategically managing the organizational goals.

What are the pros and cons of COSO framework?

The pro of the COSO framework is that it can standardize the organizational process by embedding the framework into the organization, and the con is that implementing the framework can initially be restrictive and difficult without sufficient manpower.

No organization is risk free. There have been several incidents in the past when frauds have led to the downfall of organizations as a whole. As the global business landscape continues to evolve, it is essential for organizations to adapt their control environment accordingly to ensure they are relevant and effective.

Realizing the significant changes to business and operating environments, the Committee of Sponsoring Organizations of the Treadway Commission (COSO) issued the Internal Control-Integrated Framework to help organizations improve confidence in all types of data and information.

In this article, we will discuss the COSO framework, its scope, key requirements, advantages and limitations, how to achieve compliance, and more.

- The COSO Framework is a comprehensive approach that helps organizations manage their internal control and risk management.

- The COSO Internal Control—Integrated Framework (ICIF) was originally issued in 1992 to provide guidance to organizations for designing, implementing, and conducting a system of internal controls and assessing its effectiveness. The framework was last updated in 2013.

- The whole purpose of updating the framework was to increase its relevance in the increasingly complex and global business environment. The 17 principles, under the five components, of the COSO 2013 ICIF are presumed relevant for all entities and need to be present and functioning to have effective internal controls.

- For ensuring compliance with the COSO framework, organizations must have all five components working optimally and in an integrated manner, the ability to predict and prepare for external factors that could prevent it from achieving its objectives, and compliance with all laws, regulations, and industry standards.

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) was established as an independent private-sector initiative to provide thought leadership through the development of comprehensive frameworks and guidance on enterprise risk management, internal control, and fraud deterrence to improve organizational performance and governance, and to reduce the extent of fraud in organizations.

The Internal Control-Integrated Framework (ICIF) and the Enterprise Risk Management (ERM) Framework are the two main frameworks issued by the committee. In 2024, COSO announced efforts to develop its third framework focused on Corporate Governance.

The COSO Framework is a system for establishing internal controls that are integrated into business processes. Collectively, these controls provide reasonable assurance that the organization is operating ethically, transparently, and in accordance with established industry standards.

The COSO Internal Control-Integrated Framework (ICIF), or the COSO Framework, was issued in 1992 to provide guidance to organizations for embedding comprehensive internal controls into business processes for ensuring ethical and transparent operations aligned with industry standards.

The framework was created by the Executive Vice President of the committee in association with private organizations, including the American Accounting Association, Financial Executives International, the Institute of Internal Auditors, American Institute of Certified Public Accountants, and the Institute of Management Accountants (formerly the National Association of Cost Accountants).

The framework is used extensively by organizations in the US to ensure compliance with the Foreign Corrupt Practices Act (FCPA) and with Section 404 of the Sarbanes-Oxley Act of 2001 (SOX). It was updated in 2013 with the objective of ensuring that organizations could continue to design, implement, and assess internal controls efficiently within an increasingly complex business environment:

The 2013 update included a 3D diagram – the COSO Cube, which showcases the interrelated nature of all the factors that comprise the internal control system.

In 2023, the committee published additional guidance for organizations to achieve effective internal control over sustainability reporting (ICSR), using the globally recognized COSO ICIF.

The COSO framework is extensively used by:

- Publicly traded companies

- Accounting firms

- Financial services firms

The framework is not mandatory for private companies but is a useful tool for improving internal controls for effective risk management.

According to COSO, internal controls are “a process, effected by an entity’s board of directors, management, and other personnel, designed to provide reasonable assurance regarding the achievement of objectives relating to operations, reporting, and compliance.”

The COSO framework lays out 3 key goals for internal controls:

| Operations | Reporting | Compliance |

|---|---|---|

| Internal controls must be applied to day-to-day processes and practices within the organization – fraud prevention, performance objectives, business efficiency measuresmeasures | Reporting is a key focus area for internal controls and includes internal as well as external reporting. It also includes both financial and non-financial reporting. The objective here is to ensure transparency, reliability, and relevance of the organization’s internal controls and reporting practices. | Compliance with legal requirements and guidelines and adherence with established industry norms is a key objective of the COSO framework |

Components of the COSO Framework

Based on these 3 objectives, the COSO Framework comprises 5 key components and 17 key principles.

Control Environment

The objective of this component is to ensure that all business practices and processes align with industry standards. It is important for running the business ethically and responsibly. A strong control environment can help an organization ensure that is compliant with regulatory requirements. It includes five key principles:

- The organization demonstrates a commitment to integrity and ethical values

- The board of directors demonstrates independence from management and oversees the development and performance of internal controls

- Management, with board oversight, establishes structure, authority, and responsibilities to achieve control objectives

- The organization demonstrates a commitment to the recruitment, development, and retention of capable, competent individuals

- The organization establishes accountability for individuals with regard to their internal control responsibilities

Risk Assessment

All businesses involve some amount of risk and the second component of the COSO framework builds on the idea that enterprise risk management is essential for managing the negative impact of risks. Key principles under this component are:

- The organization specifies clearly specifies objectives to enable identification and assessment of risks relating to objectives

- The organization identifies risks to the achievement of objectives and assesses risks to determine how they should be managed

- The organization considers the potential for fraud in assessing risk

- The organization identifies and assesses significant changes that could impact system of internal controls

Control Activities

Control activities are related to the risk management component. This component refers to internal controls that are established to ensure business processes are designed and executed in a way that the organization can achieve its goals without incurring any risks. This component includes 3 key principles:

- The organization selects and develops control activities for addressing and mitigating risks

- The organization selects and develops general controls over technology

- The organization implement policies and procedures that define control activities

Information & Communication

Timely dissemination of information to key stakeholders is critical for a robust internal controls program. It is also a key requirement for various regulations and industry standards. This component includes three key principles:

- The organization acquires or generates and uses relevant, quality information that support the functioning of internal controls

- The organization communicates relevant information internally

- The organization communicates externally, when required

Monitoring

The COSO framework places considerable importance on monitoring of processes and controls. Monitoring is essential for proactively identifying gaps or weaknesses in the control environment and addressing them in a timely manner. Key principles under this component are:

- The organization selects, develops, and performs ongoing and separate evaluations to ensure that all the components of internal controls are functioning as intended

- The organization evaluates and communicates deficiencies to relevant stakeholders for taking corrective action

The revised framework outlined some points of focus to improve the understanding of each component. These are:

- It covers all divisions and structures of the organization and its ecosystem for achieving the objectives. This includes operating units, legal entities, geographic spread, distribution networks and third-party partners.

- It creates and evaluates reporting lines to manage activities.

- It delegates authority, defines the terms of authority and limits responsibilities.

The COSO Cube demonstrates the interconnectedness of an organization’s internal controls system and the relationship between each component.

The COSO Cube demonstrates the interconnectedness of an organization’s internal controls system and the relationship between each component.

Adherence to the COSO Framework offers a number of advantages:

- It standardizes the functioning of business processes in accordance with the internal controls.

- Well-designed internal controls systems can help reduce risks and improve operational efficiency.

- An organization that fully deploys the COSO framework is better equipped to identify and remediate fraudulent activity – both external and internal.

- As a result of COSO’s focus on operations, organizations can improve process efficiency and reduce costs.

There are also some limitations to implementing the COSO framework.

- Its broad scope and definition allow a wide range of companies to use it. But it lacks prescriptive guidance.

- The structure of the framework can be difficult to implement. It is divided into discrete categories, but organizations may find one or processes that either don’t align with any category or fall under multiple categories.

- The framework emphasizes fraud prevention and risk mitigation but cannot eliminate the risk of incidents caused by human error and external events.

Here are a few measures that can help organizations achieve compliance with the COSO framework:

Role of Internal Audit

The internal audit team has a crucial role to play in helping the organization to achieve compliance with the COSO framework. The audit committee, internal audit team, and other risk management teams must work together to implement an integrated strategy to understand the state of COSO compliance, identify the gaps, and define a roadmap for implementing the transition quickly and efficiently. The team must also review and update audit plans.

The internal audit team has to leverage the right technology solutions and use them as enablers for greater transparency and accountability for internal control and various internal audit functions. The COSO framework provides a new opportunity for internal audit committees to take a fresh look at internal control, create value for the organization and manage elevated expectations regarding internal control.

Technology Support and Implementation

By leveraging technology, organizations can simplify the process of designing, assessing, and enhancing internal controls and evaluate their efficiency. It will also help record and store data pertaining to internal controls testing by internal auditors to present during external audits.

Centralized Approach

Organizations should create and maintain a centralized repository to document and record internal controls and define their relationships with assets, risks, policies, regulatory requirements, etc. This centralized approach helps eliminate silos to provide 360-degree visibility into compliance issues, status, and plans.

Comprehensive Risk Assessments

It is essential to devise a sound risk assessment plan based on likelihood and impact. Risk teams should create a plan for the tests that must be implemented for each vulnerable area to ensure better protection.

Continuous Monitoring and Reporting

Organizations should simplify and automate monitoring and reporting functionalities with robust internal control design, clearly designated responsibilities, and testing plans.

MetricStream empowers organizations to create, evaluate, and enhance internal controls in line with the COSO framework. It facilitates the establishment of a structured approach for assessing the efficiency of internal controls and simplifies the process of furnishing evidence to external auditors that an internal control was adequately tested by the audit team. With MetricStream, organizations gain better control over and visibility into compliance posture, related issues, and statuses.

With MetricStream, you can:

- Ensure a unified approach for managing risk and control data across financial processes leading to greater confidence in SOX compliance

- Leverage rationalized controls resulting in reduced compliance costs and efforts

- Streamline processes for control testing, documentation, and issue remediation, ensuring consistency

- Facilitate accurate and reliable data on control testing, certifications, and issue resolution to improve stakeholder confidence

To learn more about how MetricStream can help with IT compliance management, request a personalized product demo.

What are the 5 components of the COSO framework?

The five components of the COSO framework are control environment, risk assessment, control activities, information and communication, and monitoring.

What is the COSO Internal Control-Integrated Framework?

The Internal Control-Integrated Framework, commonly known as the COSO framework, is the framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) to provide guidance to companies for designing, implementing, and conducting internal controls and assessing their effectiveness. It was originally issued in 1992 and then updated twice in 2013 and 2017.

How do organizations use the COSO framework?

Organizations use the COSO framework to ensure that their internal control systems adapt easily to the evolving business environments and requirements, effectively mitigate risks, and drive sound decision-making.

What is the COSO framework process?

The COSO framework process is a structural approach to implement, design, and c ontrol the organization’s internal controls.

What are the objectives of the COSO framework?

The objectives of the COSO framework is to manage the risks while strategically managing the organizational goals.

What are the pros and cons of COSO framework?

The pro of the COSO framework is that it can standardize the organizational process by embedding the framework into the organization, and the con is that implementing the framework can initially be restrictive and difficult without sufficient manpower.